Risk management might seem like a big corporate term, but I’m going to show you why it’s just as important for small businesses – probably even more so. When you’re running a small business, any setback can have a significant impact. And that’s exactly why risk management is critical: it’s the process of identifying, analyzing, and responding to risk factors throughout the life of your business.

You’re going to find out about the various types of risks small businesses face. This isn’t just about financial risks, it’s also about legal, strategic, reputational, and operational risks among others. Imagine a scenario where a legal change affects your operations, or an unexpected financial crisis hits your industry – these are all potential threats that can derail your business if you’re not prepared.

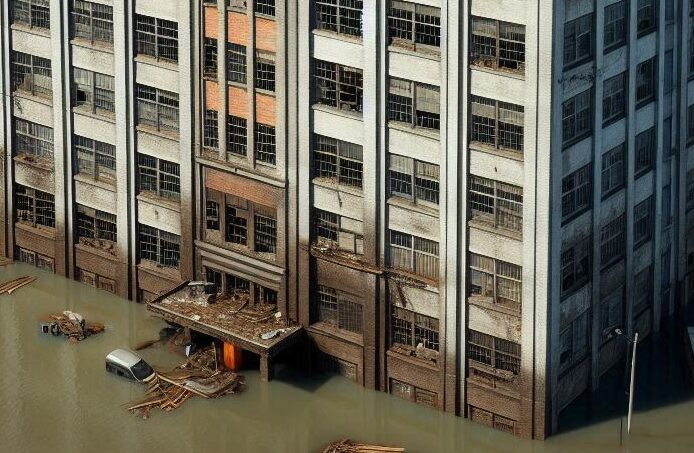

Let’s also talk about the real impact. Unplanned events or disasters – think natural disasters, cyber-attacks, or major market changes – can have devastating effects on small businesses. I’ll walk you through some cautionary tales and case studies that highlight the tangible costs and stresses of being caught off guard.

And I really hope that you’ll see risk management in a new light by the end of this section. It’s not about pessimism; it’s about empowering your business to face uncertainties head-on. This foundation is going to smoothly carry us into the next step – identifying the specific vulnerabilities your business might have. That’s where we’ll start developing your unique risk assessment strategy.

Risk Assessment Strategies: Identifying Potential Threats

I’m going to walk you through the steps to assess risks that could threaten your business. It’s not just about spotting the obvious dangers; it’s also about uncovering the hidden ones that can sneak up on you. In my experience, a comprehensive risk assessment involves systematically reviewing what could possibly go wrong and how those issues could affect your entire operation.

Now what is a big concern for many is not having a clear direction on how to identify these business vulnerabilities. To simplify it, you can always start with some cornerstone techniques like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), which helps pinpoint areas of improvement and potential danger zones.

You’re going to find out about the kinds of tools that can support your risk identification efforts. This could include specialized software for tracking and managing risks or even simpler methods like regular team meetings and brainstorming sessions where employees can voice concerns about potential risks.

Prioritization is key. Once you’ve listed all the potential risks, you need to determine which ones could hit hardest. I like to use a basic risk matrix that considers both the likelihood of an event and its potential impact. This way, you focus on what matters most, preventing a small hiccup from becoming a serious problem.

But remember, your assessment isn’t a one-and-done deal. Cultivating an ongoing culture of risk awareness is crucial. It’s about encouraging your staff to keep their eyes open and communicate about any new threats they might perceive. This ongoing vigilance can be your best defense against emerging risks.

Developing a Risk Management Plan: A Guide for Small Business Owners

Developing a risk management plan might seem daunting, especially if you’re running a small business and wearing multiple hats. But it’s essential for safeguarding your operations, finances, and reputation. Let’s break down what goes into a solid plan.

First off, there are a few key elements every risk management plan should include: clear objectives, identified risks, assessed vulnerabilities, and predefined mitigation strategies. You’re going to find out that it’s not just about identifying what could go wrong; it’s also about having a ready-to-go playbook for when things do take an unexpected turn.

When we talk about mitigation strategies, these can range from simple procedural changes to investing in specific insurance policies. The trick is to choose what resonates with you and what’s practical for your business. For instance, you can set aside a financial reserve to address unforeseen expenses, or you can establish training programs that prepare your team to handle disruptions effectively.

Insurance plays a crucial role and shouldn’t be overlooked. It can be the safety net that keeps a small mistake from turning into a business-ending catastrophe. Determine what types of insurance coverage are most relevant to your industry and operations, such as liability insurance, property insurance, or professional indemnity insurance.

Some insurance companies will offer a product called Business Interuption insurance. This is a necessary product for all businesses but particularily critical for a manufacturing company. The objective of Business Interiuption os to cover the financial impact of a catastrophe. The policy covers things like supplier interuption, fires and natural disasters or the complete destruction of your facility.

Finally, implementing your risk management plan isn’t a one-time event. It’s about continuous commitment. Regularly updating your plan to reflect business growth, market changes, and past incidents is just as important as the initial development. It ensures that your strategies evolve and remain effective over time.

With an effective risk management plan in place, you’re not just protecting your business; you’re positioning it to thrive despite the hiccups. In the next section, ‘Monitoring and Reviewing: Ensuring Your Risk Management Adapts with Your Business,’ we’ll discuss how to stay on top of your risk management game by keeping your strategies up to date and learning from past experiences.

Monitoring and Reviewing: Ensuring Your Risk Management Adapts with Your Diagnosis

Now, you’ve come a long way in setting up a robust risk management plan for your small business. But remember, risk management isn’t a one-and-done deal. It’s an ongoing process that requires attention as your business evolves. Let’s talk about keeping your strategy fresh and effective.

Conducting regular reviews of your risk management plan is essential. This doesn’t mean a quick glance over; it means a thorough assessment to ensure every aspect of your business is covered as it grows and changes. Calendar quarterly reviews, or after major business events, to ensure you’re always on top of potential risks.

I’m going to show you how to stay ahead of the game. Effective monitoring includes keeping an eye on internal changes, like new employees or changes in workflow, and external forces, such as legislative updates or market shifts. Tools like risk dashboards can be incredibly helpful, giving you a visual snapshot of where you stand at any given time.

You’re going to find out that sometimes, despite your best efforts, things can go wrong. This isn’t a failure on your part—it’s an opportunity to learn and grow. Analyze what happened, make adjustments to your plan, and communicate these changes to your team. Embrace these experiences; they’re valuable lessons, not setbacks.

Remember, when done right, risk management can be your business’s best friend. It helps you anticipate bumps in the road and plan your course accordingly. As you’ve seen in some of the case studies sharing positive outcomes, a well-maintained risk management process can lead to smoother operations, increased trust from stakeholders, and ultimately, a more resilient business.

In my opinion, a business that learns from its experiences and adapts its risk management accordingly isn’t just surviving; it’s thriving. And that’s the goal, isn’t it? To not only withstand the storms but to sail through them with confidence. Keep tweaking, keep learning, and keep your business prepared for whatever comes its way.